https://csnbbs.com/thread-926475.html

Statistical Prospects For The ACC and B1G: Those Who Actually Add Value

Average Gross Total Revenue: $106,455,758

Those Who Would Add Revenue:

1. Kansas

2. T.C.U.

Attendance: 47,706

Those Who Exceed The Attendance Average:

1. Iowa State

2. West Virginia

3. Oklahoma State

4. Texas Tech

5. Kansas State

********************************************

B1G:

Average Gross Total Revenue: $130,698,413

Those Who Would Add Revenue: (adjusted up 15.5 million B10 media diff)

1. Notre Dame

2. Florida State

3. Louisville

4. Washington

5. Stanford

6. Southern Cal

7. Clemson

8. U.C.L.A.

9. Miami (at the average)

Those Who Exceed The Attendance Average:

1. Clemson

2. Notre Dame

3. Washington

Teel: ACC 'seems positive and unified' with realignment talk ignited anew

In short, football accounts for 75-80% of conference revenue.

SO WHAT’S THE ACC’S MONEY PROBLEM?

Record numbers aside, the league’s average distribution ranked last among the Power Five conferences. Moreover, it lagged far behind the Big Ten’s $54.3 million and SEC’s $45.5 million, gaps that soon will widen.

While the ACC’s exclusive TV deal with ESPN runs through 2035-36, the Big Ten is negotiating new contracts that will start in 2023 and were projected, pre-COVID, to boost distributions to $70 million by 2025. The SEC already has announced a new arrangement that, starting in 2024, gives ESPN exclusive rights to its football and men’s basketball.

The notable change for the SEC and ESPN is the move of the league’s marquee 3:30 p.m., Saturday football game, currently aired on CBS, to ESPN/ABC. For that one weekly game, ESPN agreed to pay a reported $300 million annually, almost as much as it pays for the entire ACC sports portfolio.

Add the Texas and Oklahoma brands, and the SEC package becomes even more valuable.

the Big Ten Network launched in 2007, the SEC Network in 2014, the ACC Network in 2019.

Realignment: How much value does a team bring to their conference?

I've been hearing a lot about how certain teams are a good fit/not a good fit for conferences and a lot of people arguing about how much value they would bring to the table. That said, it was a lot of talking heads making generalizations without much in the way of hard data. I took some time to try to valuate each team in regards to their conference deal to get a sense for what they are worth to the conference. While changing conferences does not equate to an even transfer of value (and quite frankly, UT and Oklahoma moving will likely destroy a lot of value), I thought it was good to get a directional sense of what moves might work.

Method

I took the revenue value each AD brought to their respective university and also their social media following (as a rough proxy for viewership which would be the holy grail) and tied it to each school (via USAToday and SkullSpark)

From there, I captured what each teams equal payout is under the current system, and compared to what their proportionate payout would be if it was entirely based on % of revenue and/or social media following

Finally, I used a weights of the two variables to create a weighted value

Findings

Top teams in each conference really carry the bottom of the conference. There is a lot more to gain jettisoning the bottom half of each conference rather than trying to snag a top tier team from another conference.

In that respect, Oklahoma and Texas leaving the B12 makes a ton of sense from their perspective, there just isn't much comparative value from a brand perspective when comparing to the next rung down.

For the B1G - the idea of raiding the PAC12 needs to be approached with a healthy amount of caution. The plan doesn't make a ton of sense unless you get Oregon and UW in the mix. The California schools aside from USC are going to be a major drag on the per team payouts as they don't bring nearly enough to the table in today's current landscape.

Key Point: as this expansion continues, there are <20 teams that have enough value to sway the B1G or SEC to push forward with additions while increasing the per team payout. It becomes a really difficult game of choosing who comes along with when adding to the conferences

Comments

I've come across a few valuations online via WSJ, Forbes etc. that all look they come from the same place and use profit as the value predictor. To me that seems like an absolute wrong way to value an organization that is a non-profit by nature and is closer to a growth stage company than corporation

Would have loved to include revenue growth rates and viewership in the model, but getting the data for colleges is like pulling teeth and just plain too hard for a pet project

Private school data is all estimated based on comps. I didn't even try for the AAC schools because I don't think there are great comps available

TLDR: Very few teams have enough value/reasoning to make a conference shift

During the conference-realignment tornado, some of the names tossed around in rumors were Clemson, Ohio State, Florida State, and Michigan.

— CFB Kings (@CFBKings) July 28, 2021

Here’s how each has faired in their last ten games vs. SEC opponents.

Clemson: 8-2

Ohio State: 2-8

Florida State: 7-3

Michigan: 4-6 pic.twitter.com/ItmRuf2K2y

The “super schools” per the article … https://t.co/0giyL9mRH0

— 𝗢𝗫𝗩𝗧 (@OX_VT) July 29, 2021

Alabama

Auburn

Clemson

Florida

FSU

Georgia

Iowa

LSU

Miami

Michigan

Michigan State

Nebraska

Notre Dame

Ohio State

Oklahoma

Oregon

PSU

Tennessee

Texas

Texas A&M

USC

Virginia Tech

Washington

Wisconsin

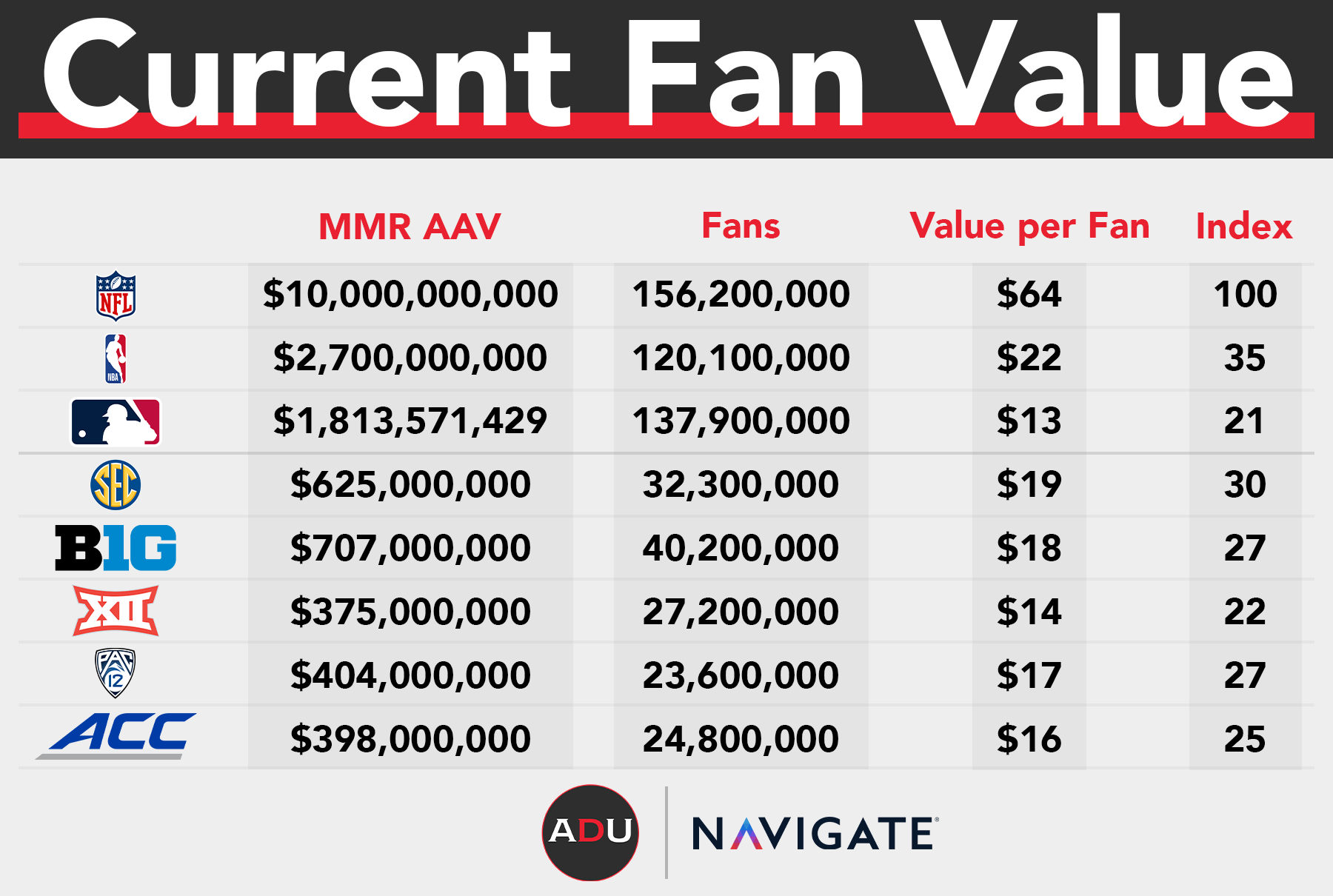

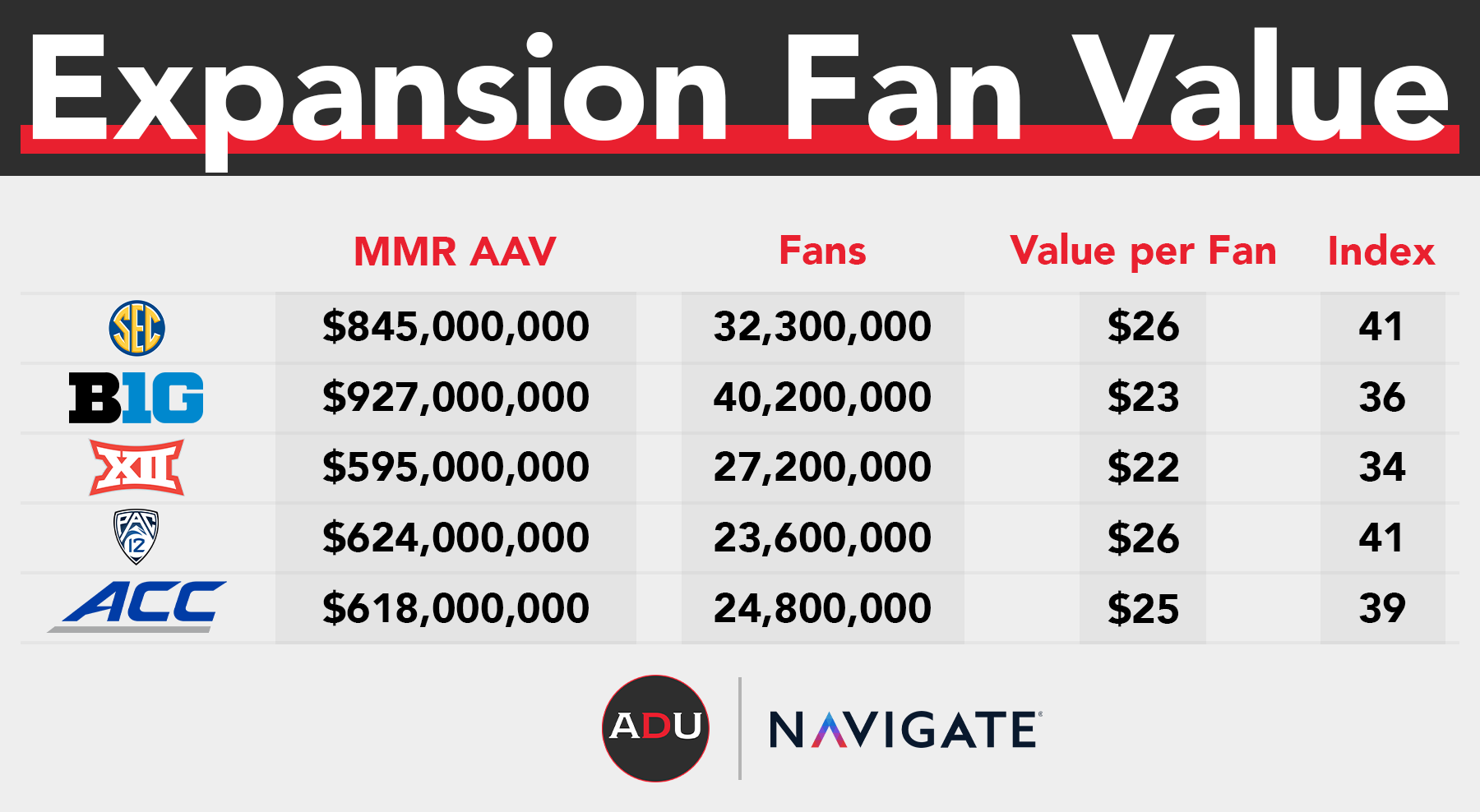

The chart above includes an index which allows us to compare the value per fan relative to the NFL for each league. The current CFP structure pays conferences around $103m per year, whereas an expanded 12-team playoff would pay closer to $323m per year, allowing us to create the below projections.

The current P5 average is only 26% of the way to NFL deals, while the new expansion would put college football closer to 38% of the way there. For perspective, 26% for now puts college football somewhere between NBA and MLB in terms of monetization, but the adjusted CFP would put college football above the NBA, which would be #2 among this comparison set.

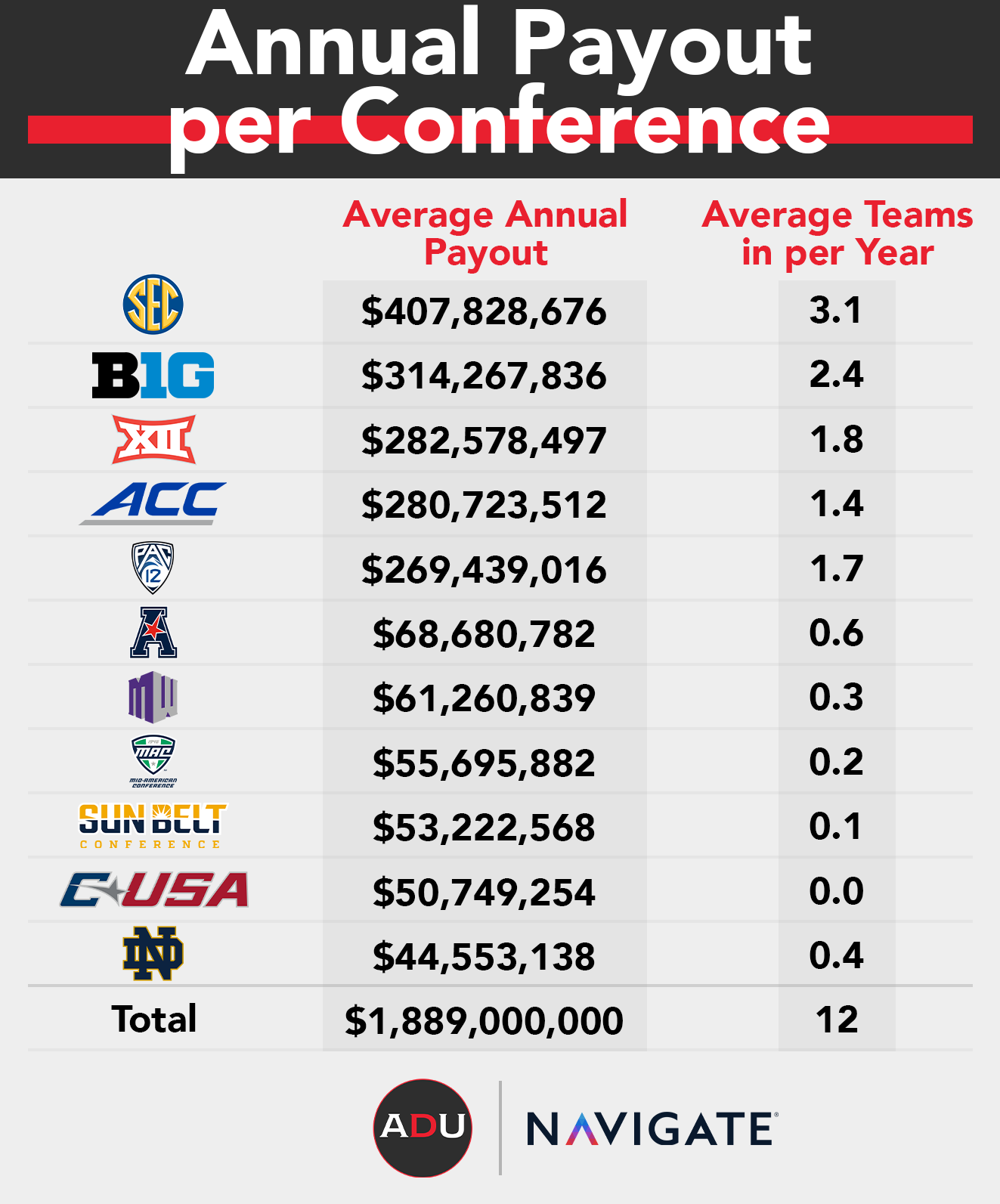

So how much money could a new 12-team CFP really generate on a per-conference basis? The below chart is our forecast and assumes the following:

- The current CFP payout for NY6 bowl games – including the 3 CFP games – pays all conferences $670M per year

- The new CFP payout for 11 playoff games that also take over all NY6 game relationships in a 12-team playoff pays all conferences $1.9B per year

- In the current model, 63% of payout goes towards base payments to conferences and the remaining 37% goes towards conferences in NY6 bowls and playoff games, which was also assumed in this new model

- To allocate non-base payouts, we looked back at the last 10-years of college football performance and assumed the new proposed 12-team playoff rules are used for participation to estimate the number of teams included in the playoff each year

- To estimate the value of each round participating, we assumed each round of the playoff sees increased TV viewership by 25%, and assigned values to each game, and totaled those estimates by conference and averaged them over the same 10-year timeframe

Our results show that had the 12-team model existed from the onset of the CFP, the SEC would have averaged 3+ teams and over $400M in payouts per year with Big Ten next at 2+ teams and $300M+ each year, followed by Big 12, ACC and then Pac-12 in terms of payouts. It’s also very interesting to note that Notre Dame ends up in a very favorable position if this scenario plays out as they would have been included in the 12-team playoff about 30% of the time and keeping full game payouts as opposed to splitting between other conference members.

Of course, the big caveat here is that we don’t really know how funds would be distributed in this scenario, but if the rules are similar as they are today with some adjustments to NY6 payouts being linked with specific rounds of the playoffs instead of with conferences, this could be the result.

With news of Texas and Oklahoma possibly headed to the SEC, how would the this change the per-conference payout picture? As the chart below shows, the average payout per team for an SEC conference with 16 members is $28M, which is also the payout per member for the Big 12 before losing Texas and Oklahoma. So, the CFP payouts would essentially be the same under each scenario for UT and OU, but they’d face a much harder path to the expanded playoff by switching conferences.

Found on CSNBBS (posted by JRSEC)

— Hokie Mark (@mark_hokie) July 24, 2021

2020-21 P5 Avg payouts by Conf (including media revenue, CFP, and bowls):

B1G: $52.10M

SEC: $48.07N

B12: $39.91M*

ACC: $33.60M

PAC: $33.60M

* not including T3

No comments:

Post a Comment