Great research by ACC Football RX

Trend: NCG TV Viewers

Many have pointed out that the TV numbers for this year's national championship game between Alabama and Georgia was the second lowest since the CFP began (only last year was lower), and is 4th from the bottom when you toss in the BCS years...

| YEAR | WINDOW | GAME | RTG | Vwrs(M) | NET |

| 1998-99 | Fiesta (NC) | TENN-FSU | 17.2 | 26.112 | ABC |

| 1999-00 | Sugar (NC) | FSU-VT | 17.5 | 26.962 | ABC |

| 2000-01 | Orange (NC) | OKLA-FSU | 17.8 | 27.24 | ABC |

| 2001-02 | Rose (NC) | Miami-NEB | 13.8 | 21.559 | ABC |

| 2002-03 | Fiesta (NC) | OSU-Miami | 17.2 | 29.104 | ABC |

| 2003-04 | Sugar (NC) | LSU-OKLA | 14.8 | 23.937 | ABC |

| 2004-05 | Orange (NC) | USC-OKLA | 13.7 | 21.419 | ABC |

| 2005-06 | Rose (NC) | TEX-USC | 21.7 | 35.63 | ABC |

| YEAR | WINDOW | GAME | RTG | Vwrs(M) | NET |

| 2006-07 | BCSNC | UF-OSU | 17.4 | 28.795 | FOX |

| 2007-08 | BCSNC | LSU-OSU | 14.4 | 23.069 | FOX |

| 2008-09 | BCSNC | UF-OKLA | 15.8 | 26.767 | FOX |

| 2009-10 | BCSNC | ALA-TEX | 17.2 | 30.776 | ABC |

| 2010-11 | BCSNC | AUB-ORE | 15.3 | 27.316 | ESPN |

| 2011-12 | BCSNC | ALA-LSU | 14 | 24.214 | ESPN |

| 2012-13 | BCSNC | ALA-ND | 15.1 | 26.38 | ESPN |

| 2013-14 | BCSNC | FSU-AUB | 14.8 | 26.205 | ESPN |

| YEAR | WINDOW | GAME | RTG | Vwrs(M) | NET |

| 2014-15 | CFPNC | OSU-ORE | 18.6 | 34.148 | ESPN |

| 2015-16 | CFPNC | ALA-CLEM | 15 | 26.182 | ESPN |

| 2016-17 | CFPNC | CLEM-ALA | 14.2 | 25.266 | ESPN |

| 2017-18 | CFPNC | ALA-UGA | 15.6 | 28.443 | ESPN |

| 2018-19 | CFPNC | CLEM-ALA | 13.8 | 25.28 | ESPN |

| 2019-20 | CFPNC | LSU-CLEM | 14.3 | 25.588 | ESPN |

| 2020-21 | CFPNC | ALA-OSU | 10.3 | 18.653 | ESPN |

| 2021-22 | CFPNC | UGA-ALA | | 22.6 | ESPN

|

Most teams pull in a big number the first time they are in the championship, only to drop off in return trips. For instance, Georgia vs. Alabama part I drew 28.443 million viewers in 2017 - which was also the Bulldogs first trip to either a BCS or CFP championship game. The rematch this year? only 22.6 million viewers - a drop of nearly 6 million!

I said not all teams suffer this drop off with repeated trips to the big game. Which teams? Clemson for one. The Tigers have played in four title games and stayed between 25.2 and 26.2 million viewers in all of them. More proof? Alabama has remained in the NCG, but viewership has tanked without Clemson.

The LSU Tigers have also been steady in their four appearances, ranging from 23.1 to 25.6 million.

Finally, do you want a team which consistently draws big numbers? Look no further than the Florida State Seminoles! In four trips to the BCS and CFP championship games, the Noles have never drawn less than 26.1 million viewers - and they maxed out at 27.2 million in 2000.

College football’s biggest threat is the continued regionalization of success and interest in the sport

Is the south's dominance of college football becoming problematic for the sport?

A little over a year ago, I published my second installment of

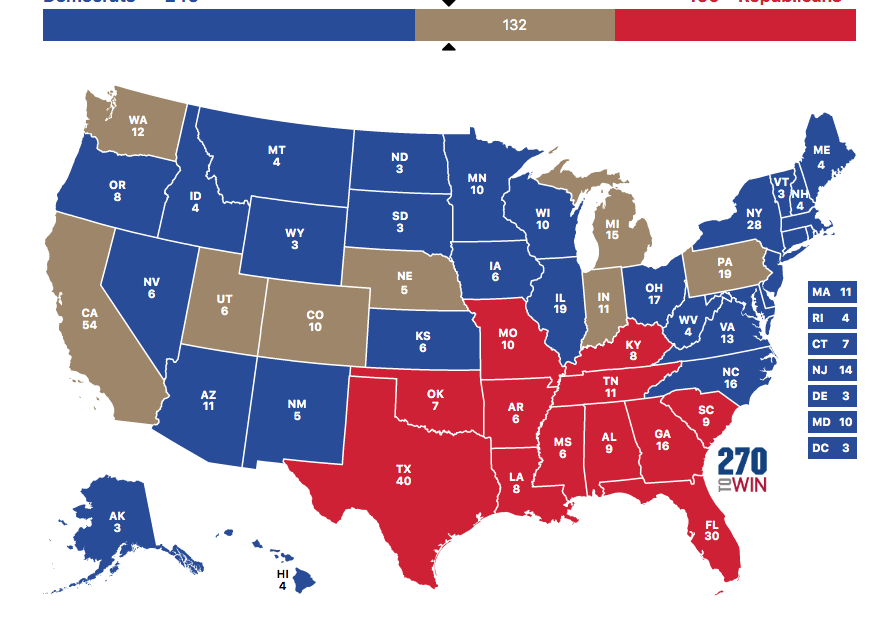

The Electoral Map Of Football, an attempt by me to figure out the national electoral preference of football between the NFL and college football. By flipping North Carolina and Virginia to college football states, the result was closer than you’d imagine and you’d think indicate that college football is perhaps narrowing the gap with the NFL in terms of interest.

But of late, the ratings have presented a bit of different picture and particularly the ratings

for the College Football Playoff, which has largely been dominated by the SEC and to a much greatest extent to the SEC’s footprint (states with SEC teams in them). Looking at how things have gone in the playoff era you begin to see a concerning trend.

The Pac 12 hasn’t appeared in the four-team playoff the last five years.

The Big 12 has only had one school make the playoff (Oklahoma, who is leaving for the SEC) and has never won a game in the playoffs’ eight-year existence.

The Big Ten and ACC have had some success making the playoff regularly, but in eight years both conferences have only had one school actually win a game in the playoff.

Focusing a bit more on the SEC footprint, 21 of the last 24 championships come from an area of the country that represents just 160 of 538 votes on the electoral map. Ohio State’s two national championships and USC’s one represent 71 electoral votes although I think most would agree that the fandom for any California college football team is culturally a bit more muted than other parts of the country even in an upswing.

Looking at the part of the country outside of the SEC footprint that has not won a championship, you’re looking at a 303 electoral compared to the 160 who have won a championship in the SEC’s footprint and then 71 (Ohio and California) who have won a championship outside of the SEC’s footprint.

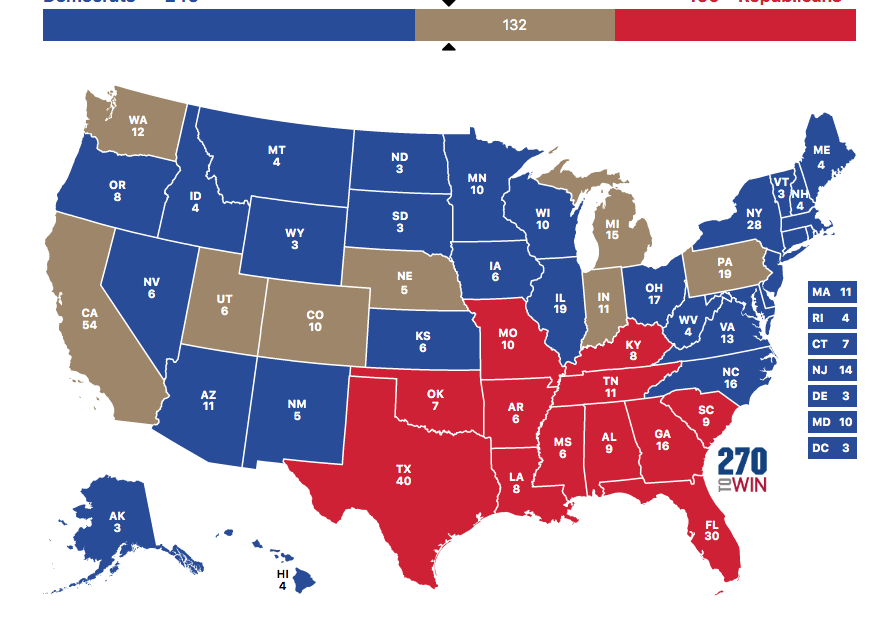

Now if you’re thinking all of this is a bunch of smoke and mirrors to make a point, let’s look at the same map for the 24 years prior to the BCS era. Most glaring is the gold states signifying states who had won a title in that 24-year span outside of the South. That’s a MUCH different map than the one above.

In this map, you have eight non-SEC footprint states now having won a championship instead of two over the last 24 years. The same summary we did for the last 24 years is done below for the 24 years before the BCS below (with the more recent analysis below to see side by side) Note: – There are 3 extra national championships in those 24 years based on split championships so there are 27 championships recognized.

24 years before the BCS: Three of the twelve pre-expansion SEC teams (25% of the league) had won the championship (Alabama, Georgia, and Florida). Those three teams have combined for 5 of the 27 championships (18.5%).

Post BCS: six of 12 SEC teams (50%) accounting for 14 of 24 championships (58.333%).

24 years before the BCS: Including recent and future SEC additions, the numbers go up to four teams winning national championships (Oklahoma 3x). The soon-to-be SEC would have four teams (25% of the league) accounting for 8 of the 27 championships (29%).

Post BCS: 8 of 16 teams (50%) winning 16 of 24 championships (66.66%).

24 years before the BCS: Broadening to SEC footprint and adding in seven championships added via Clemson, Florida State, Miami, and Georgia Tech, the total goes climbs to 15 of the 27 championships (55%).

Post BCS: While impressive it’s still not the 21 of 24 championships (87.5%) the SEC footprint has done the last 24 years.

I think the last stat is probably the most important. The number of championships outside of the south was at a healthy 45% in the 24 years leading up to the BCS. It was nearly a coin flip if the college football national champion would come out of the South.

Since the start of the BCS, that number is far from a coinflip as it has fallen to 12.5% in the 24 years since. It’s easy to see why with that level of recent success in the south the sport is thriving there in terms of interest, ratings, and general fandom. Unfortunately, the lesser amount of success and excitement outside the region assuredly plays a role in deflating ratings, attendance, and general participation and interest in the sport outside of the south.

in the 16 years prior to the BCS, current SEC schools only won two championships

Looking at that 24 year period before the BCS, you had fans of schools like Penn State, Pitt, Notre Dame, Washington, Colorado, BYU, Nebraska, and Michigan that probably prioritized following their team and the sport a lot more than today simply because, in their lifetime, their team had won a championship. Going back a bit further and you can add Michigan State, Iowa, Minnesota, Syracuse, and Maryland to that list. But when you go a quarter of a century without that higher watermark of relevancy, some of that regional interest begins to fade away.

Of all of those pre BCS champions I just mentioned, how many of those schools do you think will win a championship in the next 24 years? How many of these schools’ ceilings have been recalibrated where the idea of winning a national championship is just no longer realistic?

If you were to pick two teams outside of the SEC footprint to win a championship in the next 24 years, you’d probably pick the same two that did it the last 24 years in Ohio State and USC. You could argue Oregon as a team poised for similar relevance going but it’s harder to make that case given their last two coaches bolted for jobs at Miami and Florida State.

While it was encouraging to see Cincinnati and Michigan make the playoff, the lack of competitiveness of those games (joining the likes of Washington, Michigan State, and Notre Dame when matched up against an SEC team in the playoff) plus the possibility that both head coaches may be on borrowed time at those schools, doesn’t exactly point to any type of regional football market correction coming anytime soon.

You can actually feel and see college football slipping in terms of national relevance. Daytime ESPN has pushed college football further away from the constantly discussed NFL and the NBA and more towards the afterthoughts of MLB and the NHL. ESPN has largely grown comfortable ceding the majority of news-breaking of the sport to

other outlets. They’ve crunched the numbers and know that for large parts of the country, college football is much more of an afterthought than what it used to be and the NBA and the NFL are surer bets more worthy of airtime. Simply put, ESPN would rather talk NBA and NFL all day because that’s the preference of viewers in New York, Chicago, Los Angeles, Philadelphia, DC, Phoenix, Denver, the Bay Area, and Boston. If college football fans don’t want the NFL and NBA jammed down their throat, most of them can just flip over to the conference network of their choosing with ESPN well-positioned by owning the networks servicing fans in the south with the SEC Network and ACC Network.

Meanwhile, the three power conferences with TV deals coming up and unsure of their future prospects are the Big Ten, Big 12, and the Pac 12, soon to be representing those remaining 3 of the last 24 championships. While the

Big Ten is in a good position for a new deal, the Big 12 and Pac 12 are seemingly precarious positions between not much recent championship or playoff success and at a severe rating disadvantage. It’s very plausible one or both of the conferences may soon find themselves playing a majority of their games on a streaming service like Amazon Prime, Apple TV+, or ESPN+, something that will certainly not do any favors with fans or recruits.

Does playoff expansion help or hurt this trend? The BCS seemingly did away with whatever balance college football had settled into. Realignment and the playoff only accelerated the trend of southern regionalization of the sport. Seeing more teams from around the country in the playoff certainly seems like a good thing but it also opens up the door for more final fours with all southern teams, something we already saw in 2018 with Georgia, Alabama, Oklahoma, and Clemson making the playoff (Oklahoma, then in the Big 12).

Between another round of realignment, the transfer portal, NIL, and playoff expansion, we’re entering a new very different chapter of college football. These added variables have the ability to further tilt success towards the near southern monopoly over the sport. Perhaps we’ll see the opposite play out and these change agents will revert back some of the parity the sport enjoyed before the BCS.

Ultimately, college football’s growing regional imbalance of interest and success doesn’t register that much to stakeholders within the sport because it has yet to affect the bottom line. Playoff expansion actually will probably push back any real concern over this for another decade given

the amount of money it will inject into the sport. That said, it’s not hard to envision a world in the not so distant future where there are no more games to add to the playoff, conferences are too fat to expand any further, there are no more conference networks to launch, and nobody tunes in to find the stream of a lowly regular-season matchup played in a half-empty stadium between two teams that haven’t finished in the top five in 50 years. For many pockets of the country, this is already a reality and one that’s coming to many states and schools in the not-so-distant future.