https://www.bloomberg.com/quicktake/university-endowments

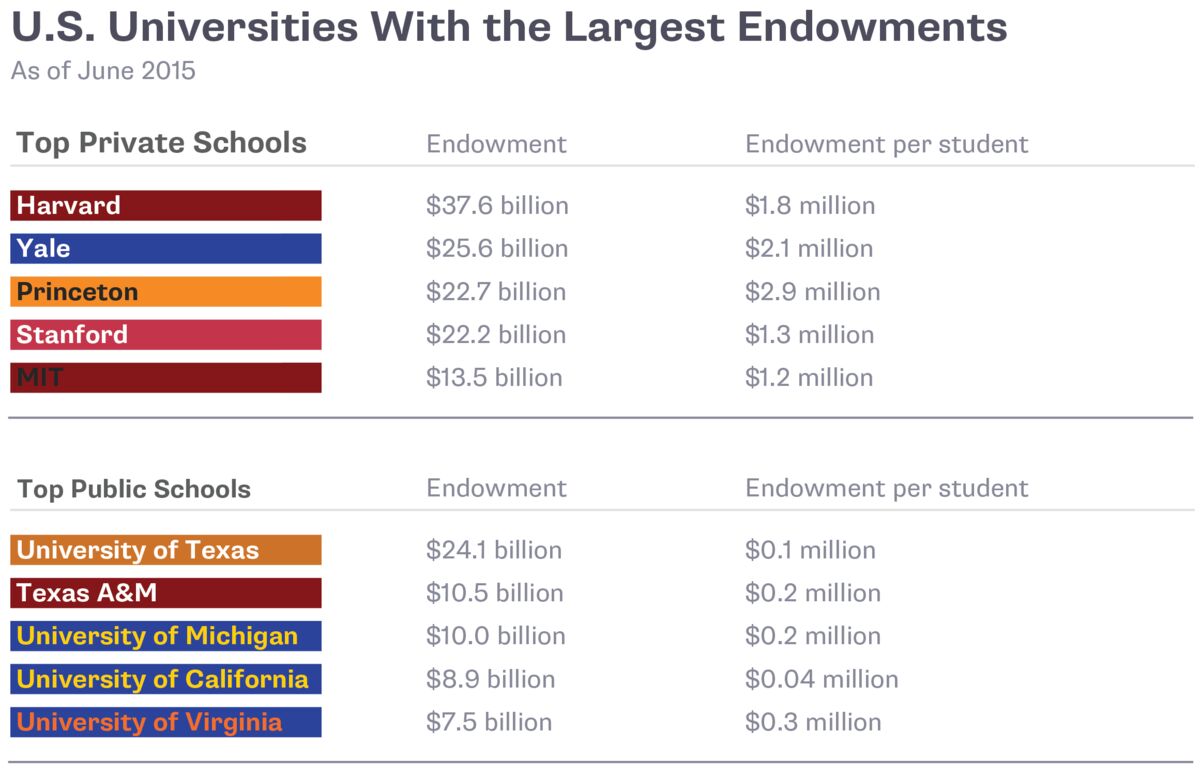

"As of June 2015, the endowments of the 812 U.S. universities that responded to an industry survey amounted to $529 billion. Some 75 percent of that was held by the wealthiest 94 universities in the survey, which each had endowments of $1 billion or more. The average return on investment in the year ending June 2015 was 2.4 percent, about half of the gain for the S&P 500 Index. "

http://www.bloomberg.com/news/articles/2016-09-12/seven-college-endowments-report-annual-losses-in-choppy-markets

"

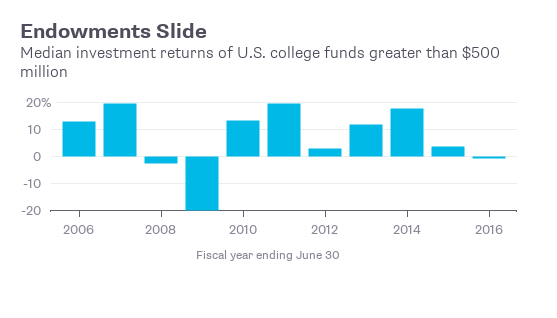

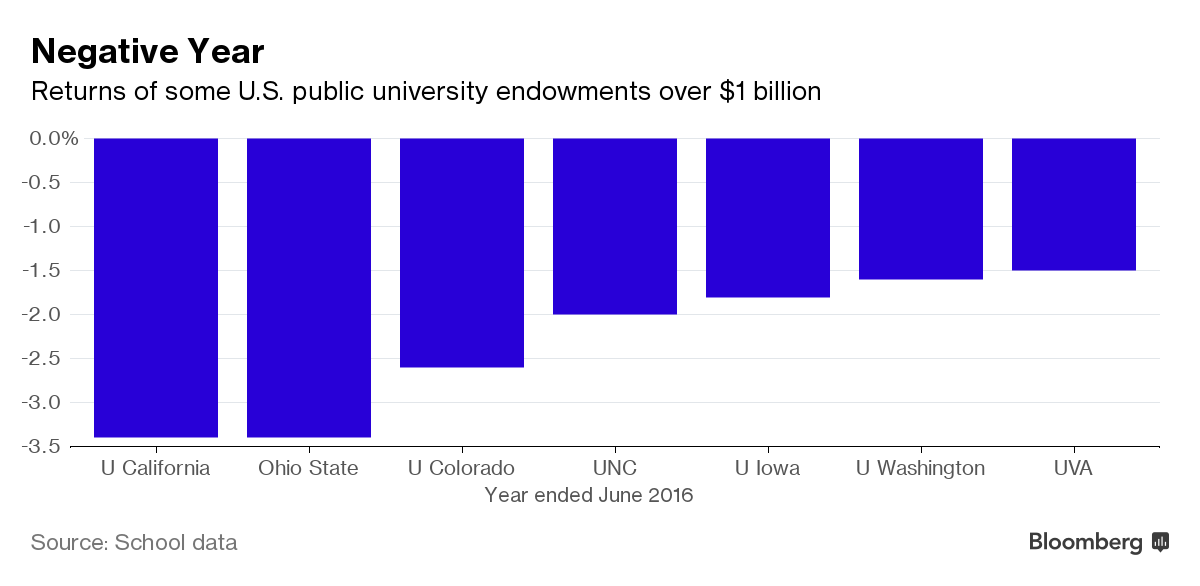

College endowments are poised to take the worst slide in performance since the 2009 recession. Funds with more than $500 million lost a median 0.73 percent in the year through June 30, according to the Wilshire Trust Universe Comparison Service. The Wilshire data, from fund custodians, excludes fees while most schools report returns net of fees.

“It was a bit of a bloodbath,” as swings in the markets challenged stock pickers, Jagdeep Bachher, chief investment officer at the University of California system, said at an investment committee meeting on Sept. 9, according to a webcast of the meeting. “Last year was a bad year for active managers all around.”

Bad sign for FSU since we historically underperform the market.

ReplyDelete