Realignment Revenue Options

Value of Schools with Regard to Realignment

A Different Way to Look at the Value of Schools with Regard to Realignment

Here is a revealing look at what each conference's media payouts would be if they were apportioned on the basis of all factors that go into the valuation of a schools athletic programs as per the Wall Street Journals assessment of those values.

Each of the P5 schools valuations were divided by that conferences total valuation to come up with a percentage of the total value that each school represents. Then the media revenue from the 2018-9 season was divided by that percentage to reveal what each school might have made if conference media contracts were not share and share alike.

I want you to pay close attention to the wide variations from top to bottom and in some cases long held beliefs of values in realignment might be shattered. Take each conference unto itself and try not to make cross comparisons as each has different percentages valid only within that conference. That said it should give you a strong indication of how solid conferences are based upon how tight the groupings are or are not. The PAC for instance is relatively compact in the difference between first and last, as is the ACC. The Big 10 is strong at the top and weak at the bottom. The ACC's laggards are rather obvious and each conference's drag on revenue is clearly revealed. But perhaps no conference is more top heavy with a greater divide than the Big 12.

It is also interesting to note how many of the programs that realigned in 2012 because of market size actually have little real value when branding, market reach, and other factors are considered.

SEC

Total Value of Media Contract $651,000,000 / Per School Payout: $46.5 million

Total WSJ valuation of the Conference $7,491,918,011

Alabama / 13.5% of Conference Value / $87,885,000 value of media share

Georgia / 11.9% of Conference Value / $77,469,000 value of media share

Auburn / 11.6% of Conference Value / $75,516,000 value of media share

Louisiana St./ 11.4% of Conference Value / $74,214,000 value of media share

Tennessee / 9.7% of Conference Value / $63,147,000 value of media share

Florida / 8.5% of Conference Value / $55,335,000 value of media share

Texas A&M / 7.2% of Conference Value / $46,872,000 value of media share

Arkansas/ 6.2% of Conference Value / $40,362,000 value of media share

South Carolina / 6.2% of Conference Value / $40,362,000 value of media share

Mississippi / 4.6% of Conference Value / $29,946,000 value of media share

Kentucky / 3.6% of Conference Value / $23,436,000 value of media share

Mississippi St./ 3.0% of Conference Value / $19,530,000 value of media share

Missouri / 1.6% of Conference Value / $10,416,000 value of media share

Vanderbilt / 1.1% of Conference Value / $7,161,000 value of media share

Big 10

Total Value of Media Contract $784,000,000 / Per School Payout: 56 Million

Total WSJ valuation of the Conference $5,389,814,258

Ohio State / 19.5% of Conference Value / $152,880,000 value of media share

Michigan / 17.2% of Conference Value / $134,848,000 value of media share

Penn State / 9.6% of Conference Value / $75,264,000 value of media share

Wisconsin / 8.8% of Conference Value / $68,992,000 value of media share

Nebraska / 8.8% of Conference Value / $68,992,000 value of media share

Iowa / 8.5% of Conference Value / $66,640,000 value of media share

Michigan St./ 6.6% of Conference Value / $51,744,000 value of media share

Minnesota / 5.0% of Conference Value / $39,200,000 value of media share

Indiana / 3.4% of Conference Value / $26,656,000 value of media share

Northwestern / 3.3% of Conference Value / $25,872,000 value of media share

Illinois / 2.9% of Conference Value / $22,736,000 value of media share

Maryland / 2.8% of Conference Value / $21,952,000 value of media share

Purdue / 2.5% of Conference Value / $19,600,000 value of media share

Rutgers / 1.2% of Conference Value / $9,408,000 value of media share

Big 12

Total Value of Media Contract $360,000,000 / Per School Payout: 36 Million

Total WSJ Valuation of the Conference $3,537,219,087

Texas / 31.3% of Conference Value / $112,680,000 value of media share (no T3)

Oklahoma / 25.0% of Conference Value / $90,000,000 value of media share (no T3)

Kansas St. / 7.8% of Conference Value / $28,080,000 value of media share

Oklahoma St. / 7.7% of Conference Value / $27,720,000 value of media share

Texas Tech / 6.9% of Conference Value / $24,840,000 value of media share

Kansas / 5.9% of Conference Value / $21,240,000 value of media share

T.C.U. / 5.4% of Conference Value / $19,440,000 value of media share

Iowa St. / 5.5% of Conference Value / $19,080,000 value of media share

Baylor / 3.0% of Conference Value / $10,800,000 value of media share

West Virginia / 1.7% of Conference Value / $6,120,000 value of media share

ACC

Total Value of Media Contract $450,800,000 / Per School Payout: 32.2 Million

Total WSJ Valuation of the Conference $2,378,969,826

Clemson / 12.5% of Conference Value / $56,350,000 value of media share

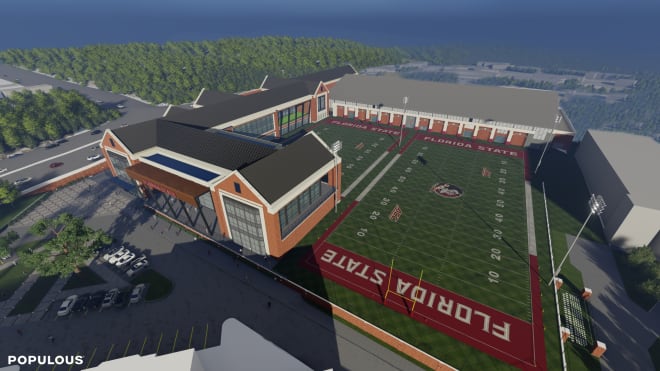

Florida St./ 12.2% of Conference Value / $54,997,600 value of media share

Virginia Tech / 11.7% of Conference Value / $52,743,600 value of media share

Georgia Tech / 9.0% of Conference Value / $40,572,000 value of media share

Miami / 8.1% of Conference Value / $36,514,800 value of media share

N.C. St./ 7.5% of Conference Value / $33,810,000 value of media share

Louisville / 7.4% of Conference Value / $33,359,200 value of media share

North Carolina / 6.5% of Conference Value / $29,302,000 value of media share

Virginia / 5.7% of Conference Value / $25,695,600 value of media share

Syracuse / 5.1% of Conference Value / $22,990,800 value of media share

Pittsburgh / 4.8% of Conference Value / $21,638,400 value of media share

Boston College / 3.4% of Conference Value / $15,327,200 value of media share

Wake Forest / 3.2% of Conference Value / $14,425,600 value of media share

Duke / 2.8% of Conference Value / $12,622,400 value of media share

* Notre Dame's value is 5th nationally so if a full member of the ACC their % of Conference value would be 27.7% and would dwarf the rest of the ACC.

PAC 12

Total Value of Media Contract $386,400,000 / Per School Payout: 32.2 Million

Total WSJ Valuation of the Conference $3,008,222,679

Washington / 14.7% of Conference Value / $56,800,800 value of media share

Oregon / 11.6% of Conference Value / $44,822,500 value of media share

U.S.C. / 10.8% of Conference Value / $41,731,200 value of media share

U.C.L.A. / 10.0% of Conference Value / $38,640,000 value of media share

Arizona St. / 10.0% of Conference Value / $38,640,000 value of media share

Stanford / 7.7% of Conference Value / $29,752,800 value of media share

Utah / 7.1% of Conference Value / $27,434,400 value of media share

Colorado / 6.9% of Conference Value / $26,661,600 value of media share

California / 6.6% of Conference Value / $25,502,400 value of media share

Arizona / 5.5% of Conference Value / $21,252,000 value of media share

Washington St. / 4.7% of Conference Value / $18,160,800 value of media share

Oregon St. / 4.2% of Conference Value / $16,228,800 value of media share

The Wall Street Journal valuation modeling above is strictly for football...the WSJ does the identical analysis for basketball. Per the WSJ valuations, basketball adds another 40% value to the ACC schools. Unlike the other power conferences, basketball does make a difference when discussing "profitability" or "free cash flow" for ACC athletic programs.Some oddities about WSJ valuations: Louisville basketball valuation ($320M) is nearly twice its football valuation ($176M); and Syracuse basketball valuation ($154M) is higher than its football valuation ($121M). If these valuations are accurate, then Louisville and Syracuse should have remained in the Big East and focused more on basketball...LOLIf WSJ valuations are to be believed as a proxy for media rights generation, then the accurate proportions would beLOU 0.50 13.3%CU 0.35 9.5%FSU 0.34 9.1%VT 0.32 8.7%UNC 0.30 8.0%SYR 0.28 7.4%DU 0.26 7.0%NCS 0.24 6.6%GT 0.24 6.4%MIA 0.23 6.2%UVA 0.21 5.8%PITT 0.20 5.5%BC 0.11 3.0%WF 0.11 3.0%ND 0.01 0.4%3.72 100.0%The second column has the combined (football and basketball) WSJ valuation in billions of US$. Notre Dame's valuation is strictly the WSJ's basketball-only data.Within the ACC, the generation of media rights payouts has little correlation to the WSJ valuation modeling. Clemson, Florida State and Miami are the bell cows that deliver media rights payouts (via viewership). To a lesser extent, Virginia Tech and Louisville are also above average contributors to the current media rights payouts.